Top Seasonal Tax Preparation Tips for Oregon Residents

Understanding Oregon's Tax System

As tax season approaches, it's essential for Oregon residents to understand the nuances of their state's tax system. Oregon is one of the few states that do not impose a sales tax, which can be both a benefit and a complexity when preparing your taxes. Instead, Oregon relies heavily on income taxes, which means residents should pay close attention to their income sources and deductions.

Stay Updated on Tax Law Changes

Each year, tax laws can change at both the federal and state levels. For Oregon residents, staying updated on these changes is crucial. Whether it's adjustments in tax rates or new deductions, being informed can help you maximize your return. Check the Oregon Department of Revenue’s website regularly for updates.

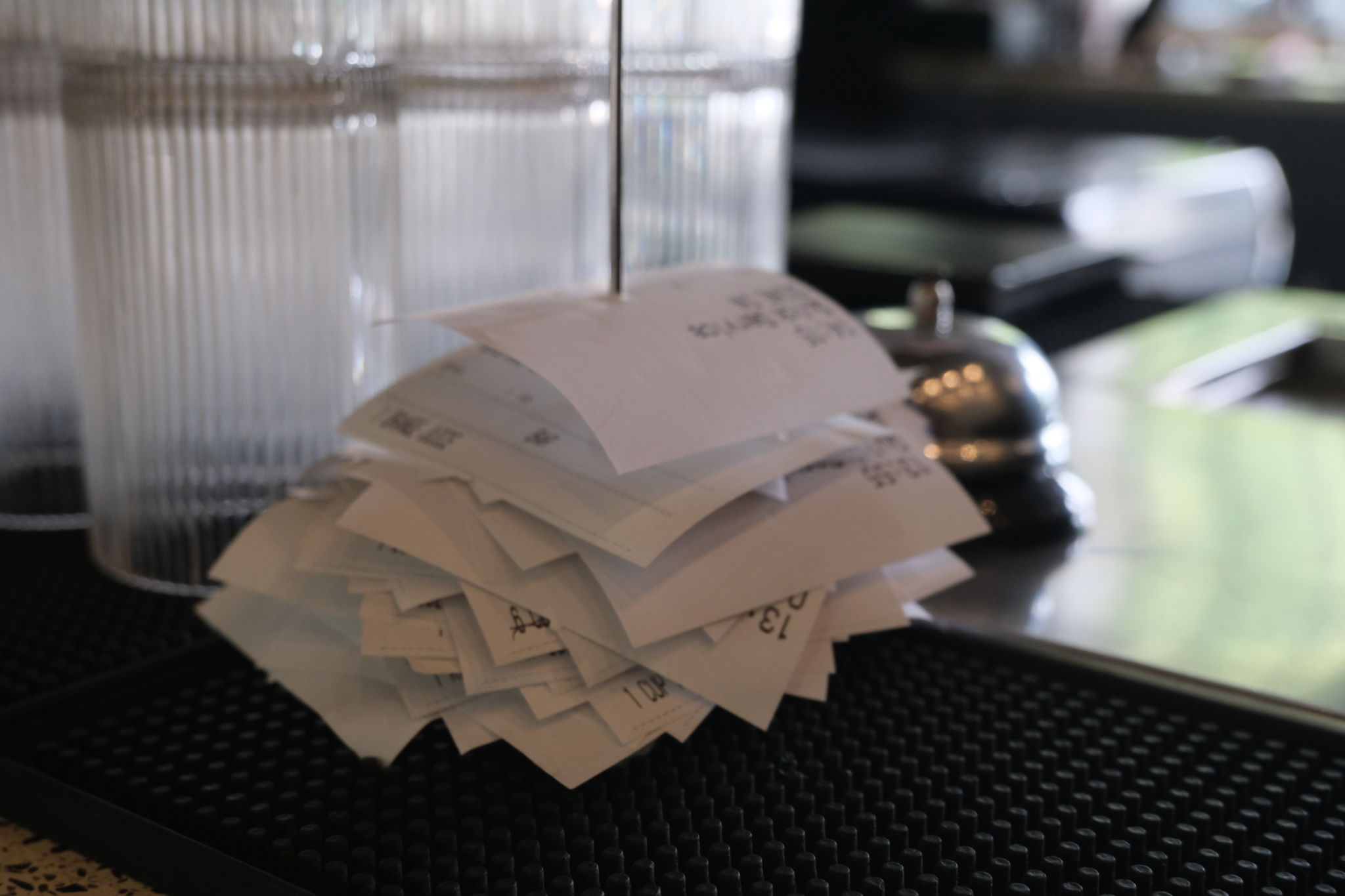

Organize Your Financial Records

Having your financial records organized can significantly streamline the tax preparation process. Begin by gathering all necessary documents such as W-2s, 1099s, and any other income-related paperwork. Don't forget about documents related to deductions like mortgage interest statements and charitable contributions.

Utilize All Available Deductions and Credits

Oregon offers several deductions and credits that can help reduce your taxable income. For instance, the Working Family Household and Dependent Care Credit can provide relief for working families. Additionally, explore deductions related to education or energy-efficient home improvements.

Consider Itemizing Your Deductions

If your eligible expenses exceed the standard deduction, itemizing could be beneficial. This includes expenses related to medical costs, property taxes, and mortgage interest. Keep detailed records to ensure all itemized deductions are accounted for and justifiable.

Leverage Tax Software or Professional Help

While many residents can handle their taxes independently with the aid of software, complex situations may require professional assistance. Tax professionals can offer tailored advice and ensure compliance with both federal and state tax laws, potentially saving you money in the long run.

Plan for Future Tax Seasons

Once you've filed your taxes, take time to reflect and plan for the future. Review what went well and identify areas for improvement. Consider setting up a filing system that will make next year's preparation smoother. Additionally, adjust your withholdings if you received a large refund or had to pay a significant amount.

Conclusion: Stay Proactive and Informed

Being proactive and informed is key to a stress-free tax season in Oregon. By understanding the state's unique tax structure, staying updated on laws, organizing records, and utilizing deductions and credits, you can navigate this annual task with confidence. Remember, preparation is not just seasonal; it's a year-round endeavor.