Preparing for Tax Season: Essential Steps for Oregon Residents

Understanding Oregon's Tax Requirements

As tax season approaches, it's important for Oregon residents to familiarize themselves with the state's specific tax requirements. Understanding these requirements can help you avoid penalties and ensure that you are taking advantage of all available deductions and credits. In Oregon, you must file a state income tax return if you are a resident or a part-year resident. Even if you are a non-resident, you may need to file if you have income from Oregon sources.

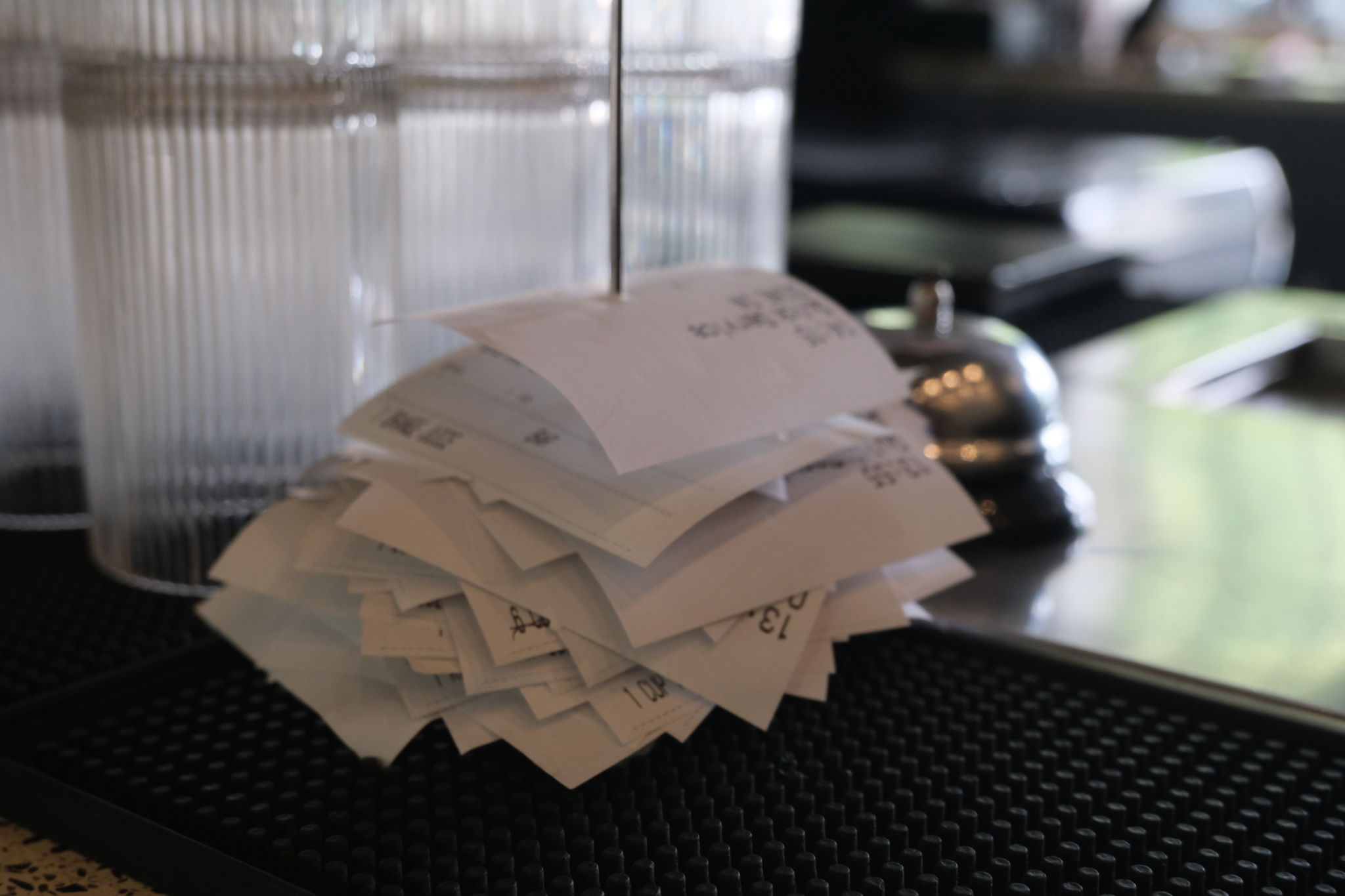

One of the first steps is to gather all necessary documentation, including W-2s, 1099s, and any other relevant financial documents. This will make the filing process smoother and more efficient. It's also wise to review any changes in tax laws from the previous year that may affect your filing.

Organizing Your Financial Records

Having organized financial records is crucial for a stress-free tax season. Start by creating a system that works for you, whether it's digital or physical. Sort your documents into categories such as income, deductions, and credits. This will help you quickly locate any needed information when filing your taxes.

Consider using tax software or consulting with a tax professional to ensure that you are accurately reporting your financial information. These resources can help identify potential deductions and credits you may have overlooked.

Maximizing Deductions and Credits

To make the most of your tax return, be sure to explore all deductions and credits available to Oregon residents. Common deductions include those for mortgage interest, student loan interest, and medical expenses. Additionally, Oregon offers a variety of tax credits, such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit.

Taking the time to research and understand these opportunities can significantly impact your financial outcome. Keep detailed records of any expenses that may qualify for deductions or credits, as this documentation will be required if you are audited.

Filing Your Tax Return

When it comes time to file, you have the option to submit your Oregon state tax return electronically or by mail. Electronic filing is often faster and more secure, with the added benefit of receiving your refund more quickly. Make sure to double-check all information for accuracy before submitting your return.

If you owe money, consider your payment options carefully. Oregon offers several payment plans if you are unable to pay the full amount by the due date. It's important to tackle any owed taxes promptly to avoid additional interest and penalties.

Seeking Professional Assistance

If the process feels overwhelming, don't hesitate to seek professional assistance. Tax professionals are well-versed in the latest tax laws and can provide valuable insights. They can help ensure that your tax return is accurate and complete, maximizing your potential refund or minimizing any amount owed.

Choosing the right professional is crucial. Look for someone with experience in Oregon tax law and a solid reputation. This investment in professional advice can save you time and stress, providing peace of mind during tax season.